The holiday season, a time of joy and generosity, often brings with it the pressure to overspend. American culture's emphasis on consumerism, amplified by Black Friday and Cyber Monday deals, can tempt us to reach for credit cards, leaving many grappling with debt long after the festivities end. This year, let's break free from this cycle and embrace a financially responsible approach to holiday spending.

While gift-giving is a heartwarming tradition, relying on credit can lead to significant financial strain. Statistics reveal that a substantial portion of shoppers incur debt during the holidays, with many still paying it off a year later. Even amidst rising living costs, overspending isn't inevitable. We can find creative ways to earn extra income or adjust our holiday budgets to avoid debt.

Unwrapping the Reasons Behind Holiday Debt

Understanding the factors that contribute to holiday debt is crucial for adopting healthier financial habits. Here are three key reasons why people often overspend:

1. Unrealistic Expectations

Social media often portrays extravagant holiday celebrations, creating pressure to replicate these experiences. This can lead to overspending in an attempt to meet these often unrealistic expectations. Remember, creating a memorable holiday season doesn't necessitate extravagant purchases. Prioritizing meaningful experiences and thoughtful, budget-friendly gifts can bring more joy than material possessions.

2. Consumer Habits

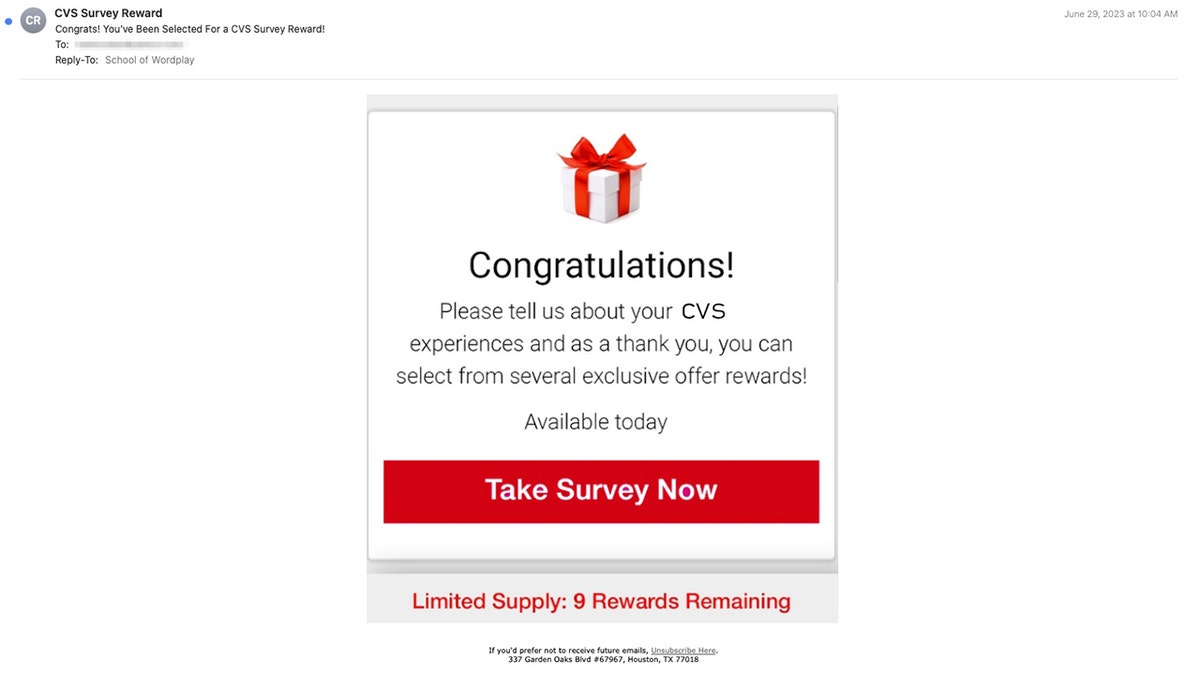

The ease of using credit cards can mask the reality of accumulating debt. Impulse purchases and shopping without a plan further exacerbate the problem. Breaking this cycle requires conscious effort. Consider using cash or debit cards to limit spending to available funds and avoid impulse buys.

Thoughtful gifts don't have to break the bank. (iStock)

3. Lack of Financial Buffer

Living paycheck to paycheck leaves little room for holiday expenses, increasing the temptation to rely on credit or buy now, pay later programs. These programs, while seemingly convenient, can lead to increased spending and potential financial difficulties down the line.

Practical Strategies for a Debt-Free Holiday

Here are four effective strategies to avoid holiday debt and enjoy a financially stress-free season:

1. Create a Holiday Budget

Develop a detailed spending plan for the holidays. Utilize budgeting apps or spreadsheets to track expenses and allocate specific amounts for each recipient. This will help you stay within your financial limits.

2. Set Realistic Expectations

Communicate openly with family and friends about your decision to avoid debt. Consider focusing on gifts for immediate family or exploring alternative gift-giving traditions, such as Secret Santa or homemade presents.

Open communication with loved ones can alleviate gift-giving pressures.

3. Embrace Creativity

Consider thoughtful, personalized gifts that don't require significant financial investment. Homemade treats, personalized crafts, or shared experiences can be more meaningful than expensive items. Prioritize quality time with loved ones over material possessions.

Creating lasting memories is more valuable than accumulating debt. (iStock)

4. Plan Ahead

Start saving for next year's holiday season as early as possible. Set aside a small amount each month to build a dedicated holiday fund. This will allow you to take advantage of early sales and avoid last-minute financial stress.

This holiday season, prioritize financial well-being and create meaningful memories without the burden of debt. By adopting these strategies, you can enjoy a truly joyful and financially sound festive season.